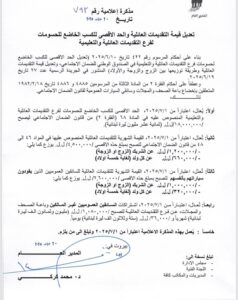

Decree #422 dated 10th June 2025, published in the Official Gazette #27 on the 19th June 2025:

1) The monthly salary ceiling subject to the family allowance of 6% has increased to LBP 18,000,000.

2) The value of the monthly family allowances have increased to a maximum of LBP 4,500,000 being:

a. LBP 1,200,000 for the partner (spouse or husband)

b. and LBP 660,000 for each child (up to maximum 5 children).

This increase will be in force starting from the month that follows its publication in the Official Gazette.

NSSF Notification #793 dated 20 June 2025 specifies that this Decree will be in force starting from the 1st July 2025.